CA FTB 3601 C3 2008-2024 free printable template

Show details

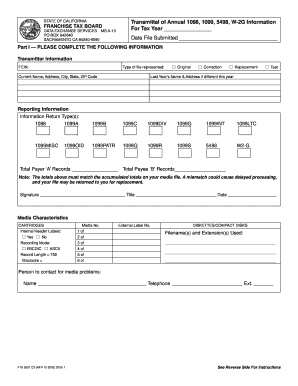

Print and Reset Form STATE OF CALIFORNIA DATA EXCHANGE MS L120 Reset Form FRANCHISE TAX BOARD Transmittal of Annual 1098, 1099, 5498, W-2G Information For Tax Year PO BOX 1468 SACRAMENTO CA 95812-1468

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your tax foreign 2008-2024 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax foreign 2008-2024 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax foreign online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit year tax form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Check it out!

CA FTB 3601 C3 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out tax foreign 2008-2024 form

How to fill out form taxpayer:

01

Start by gathering all necessary information such as your personal details, income sources, and deductions.

02

Use the provided instructions to properly fill out each section of the form. Pay close attention to any specific requirements or guidelines.

03

Double-check all the information you have entered to ensure accuracy and completeness.

04

Attach any required supporting documents or forms to the taxpayer form.

05

Review the completed form one last time before submitting it.

06

Submit the filled-out form taxpayer to the designated authority or tax agency.

Who needs form taxpayer:

01

Individuals or businesses who have taxable income and are required to report it to the tax authorities.

02

Self-employed individuals or freelancers who earn income not subject to tax withholding.

03

Anyone who has received income from investments, rental properties, or other sources that need to be reported for tax purposes.

Fill ftb c3 : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form taxpayer?

There seems to be a typo or missing information in your question. The term "form taxpayer" is not clear or commonly used.

If you are referring to a specific tax form or category related to taxpayers, please provide more context or provide the correct term so that I can provide an accurate answer.

Who is required to file form taxpayer?

Individuals who meet certain income thresholds or have specific tax situations are required to file Form 1040 (U.S. Individual Income Tax Return), which is commonly referred to as a taxpayer. The income thresholds vary based on filing status and age. It is important to consult the Internal Revenue Service (IRS) guidelines or a tax professional to determine whether filing a tax return is required.

How to fill out form taxpayer?

To fill out a taxpayer form, follow these general steps:

1. Gather necessary information: Collect all the relevant documents such as your Social Security Number (SSN), W-2 forms, previous year's tax return (if applicable), 1099 forms for additional income, receipts for deductible expenses, and any other relevant financial records.

2. Personal information: Fill in personal details such as your full name, address, date of birth, and SSN at the top of the form.

3. Filing status: Indicate your filing status, which can be single, married filing jointly, married filing separately, head of household, or qualifying widower. Choose the status that best applies to you.

4. Exemptions: If applicable, claim any exemptions for yourself, your spouse, and dependents. This can vary depending on your situation and the form you are using.

5. Income: Report your income from all sources, including wages, salaries, self-employment earnings, interest, dividends, rental income, and any other relevant income. Use the provided sections on the form, such as Schedule 1, to report different types of income.

6. Deductions and credits: Deduct any eligible expenses or claim tax credits that you are entitled to. This can include items like student loan interest, mortgage interest, medical expenses, childcare expenses, and education-related credits. Be sure to follow the instructions and fill out the appropriate sections or schedules for each deduction or credit.

7. Calculate and report tax owed: Use the provided calculations or tax tables to determine the amount of tax you owe. This will be based on your income, deductions, and credits. If you have any withholding from your paychecks or estimated tax payments, subtract them from your tax liability to determine if you owe more or will receive a refund.

8. Sign and submit: Once you have completed the form, sign and date it. If you are filing electronically, follow the procedures for e-signing or digital signatures. Make a copy of your completed form and any supporting documents before submitting the original to the appropriate tax authority (e.g., IRS in the United States).

Remember to review your completed form for accuracy and double-check all calculations before submitting it. If you are unsure about any aspect, consider consulting with a tax professional or using tax preparation software to guide you through the process.

What is the purpose of form taxpayer?

The purpose of a taxpayer form is to collect information from individuals or entities in order to determine their tax liability or eligibility for tax benefits or refunds. Taxpayer forms, such as income tax forms, are used to report various types of income, deductions, credits, and other relevant financial information to the tax authorities. These forms help the government in assessing and collecting taxes accurately and efficiently.

What information must be reported on form taxpayer?

Form 1040, also known as the U.S. Individual Income Tax Return, requires taxpayers to report various types of information. The specific information that must be reported on the form may vary depending on the taxpayer's individual circumstances, but the general categories of information include:

1. Personal Information: This includes the taxpayer's name, address, social security number, and filing status.

2. Income: Taxpayers must report the various sources of income they received during the tax year. This may include wages, self-employment income, rental income, interest and dividends, capital gains, and any other income sources.

3. Deductions: Taxpayers can claim deductions to reduce their taxable income. These may include deductions for expenses such as mortgage interest, state and local taxes, medical expenses, and charitable contributions.

4. Tax Credits: Taxpayers can claim certain tax credits to reduce their tax liability. Some common tax credits include the Child Tax Credit, Earned Income Tax Credit, and American Opportunity Credit.

5. Payments and Refunds: Taxpayers must report any federal income tax withheld from their wages, estimated tax payments made throughout the year, and any refund they received from the previous year.

6. Health Insurance: Taxpayers need to report whether they had health insurance coverage for themselves and their dependents throughout the year. They may need to indicate if they qualify for any exemptions or if they owe a penalty for not having coverage.

These are just some of the key pieces of information that must be reported on Form 1040. The form may also have additional sections or require other schedules and forms based on the taxpayer's specific situation. It is important to carefully review the instructions provided with the form to ensure that all necessary information is reported accurately.

What is the penalty for the late filing of form taxpayer?

The penalty for the late filing of Form 1040 (individual tax return) can vary depending on several factors such as the amount of tax owed, the reason for the delay, and the length of the delay.

If you file your tax return after the due date but owe no taxes or are due a refund, there is typically no penalty for late filing. However, if you owe taxes and file your return late, the penalty is usually 5% of the unpaid tax amount for each month or partial month the return is late, up to a maximum of 25% of the unpaid tax.

If you filed for an extension but failed to file the return by the extended due date, the penalty is generally 5% per month, or part of a month, of the unpaid tax amount.

It's important to note that these penalties can be waived or reduced if you can show reasonable cause for the delay in filing.

It is recommended to consult with a tax professional or refer to the official IRS guidelines for the most accurate and up-to-date information.

How do I complete tax foreign online?

Easy online year tax form completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I create an electronic signature for the form taxpayer in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your ca ftb3601c3 online in seconds.

How do I edit address foreign on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as form tax. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

Fill out your tax foreign 2008-2024 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Taxpayer is not the form you're looking for?Search for another form here.

Keywords relevant to ftb transmittal online form

Related to form tax address

If you believe that this page should be taken down, please follow our DMCA take down process

here

.